Capital Credits Look A Little Different in 2025

At Big Country Electric Cooperative (BCEC), one of the greatest benefits of membership is sharing in the success of your co-op through capital credits. Each year, margins — revenues earned beyond the cost of providing electric service — are allocated back to members based on how much electricity they used.

Unlike investor-owned utilities, which pay profits to shareholders, BCEC allocates margins to the very people who make the cooperative possible — our members. These allocations represent your share of the co-op’s financial success and your ownership in it.

2025's Capital Credit Allocation & Retirement

This year, $3,768,076.78 was allocated back to members who received electric service from BCEC in 2024. That’s the total margin earned in 2024 and assigned to individual member accounts.

From that allocation, the BCEC Board of Directors voted to retire a portion — returning $1,287,079 to members in the form of bill credits or mailed checks.

Allocation vs. Retirement — What’s the Difference?

An allocation is the amount of margins assigned to you each year based on your electricity use. These funds remain with the cooperative temporarily and are used as working capital to help finance operations — including system maintenance, pole replacements, technology upgrades, and other critical infrastructure.

A retirement is when the Board authorizes a portion of those allocated funds to be paid back to members — usually years later — as the co-op’s financial condition allows.

This system helps your co-op:

- Avoid borrowing money to fund day-to-day improvements

- Keep rates stable for members

- Maintain long-term financial health

Why Only a Portion of Allocated Capital Is Retired

Electric cooperatives operate on a not-for-profit basis, but they still need capital to function responsibly and maintain reliable service. Retaining a portion of allocated margins allows BCEC to invest in equipment, respond to emergencies, and plan for future growth — without turning to outside investors.

This year, the Board approved a general retirement of capital credits as follows:

- 80% ($1,029,663.20) will be returned to members with outstanding capital credits from 1995 and 1996

- 20% ($257,415.80) will be returned to members who earned capital credits in 2024

This blended approach, known as FIFO/LIFO (First In, First Out / Last In, First Out), ensures that both longtime and newer members benefit from capital credit retirements.

What’s New This Year?

To reduce administrative costs and simplify the process:

- Residential members (including farm and seasonal rate classes) will receive capital credits as a bill credit, applied directly to your account — no check to cash or misplace.

- Non-residential accounts (commercial, large power, irrigation) will continue receiving checks by mail, just as before.

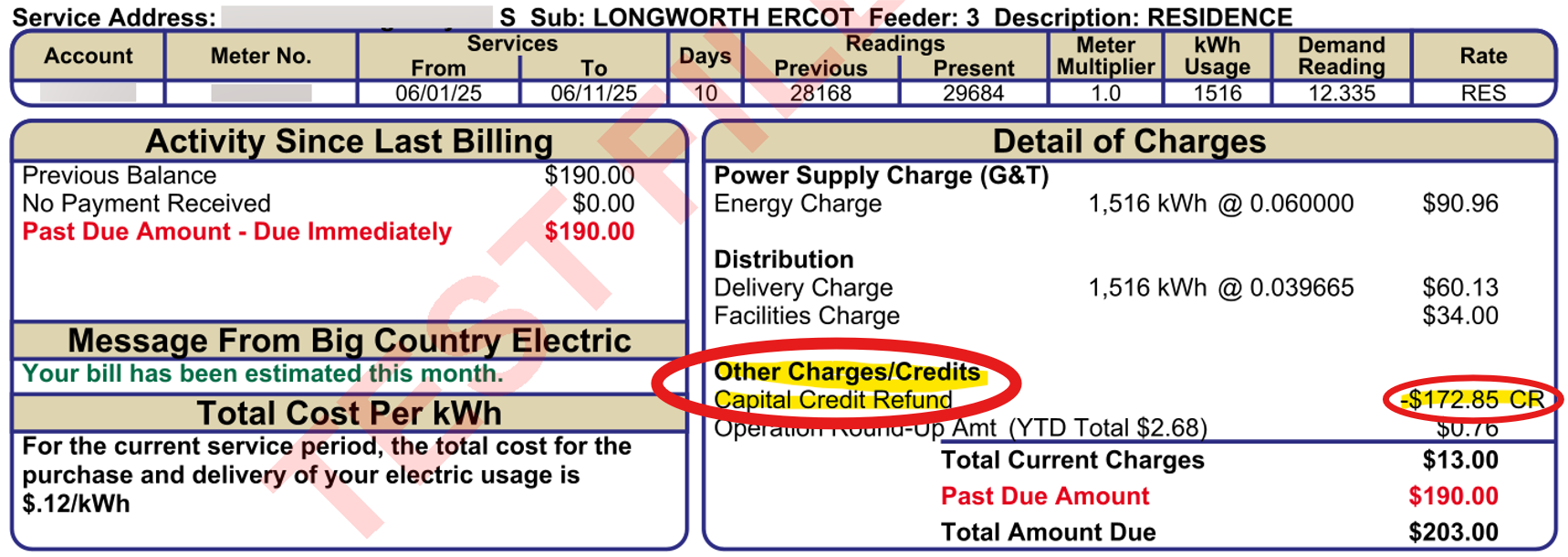

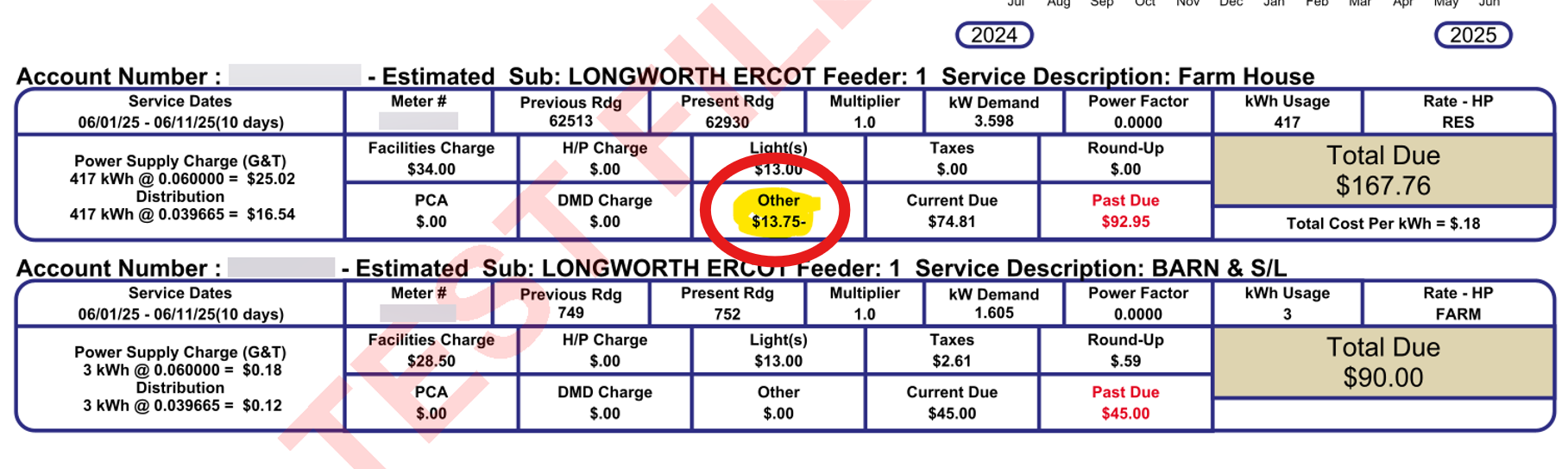

This change helps lower postage and printing expenses while still returning the same value to our members. Please note how this credit will be reflected on your bill statement.

If you have a single account/meter with us, then you will clearly see the credit on the "Detail of Charges" breakdown:

If you have multiple accounts/meters with us, and receive Group Invoice statements, you will see the capital credit listed under "Other" under the accounts:

Have Questions?

If you have questions about your allocation or retirement, please don’t hesitate to contact our office. We’re always happy to walk you through it and help you understand how capital credits work — and how they help keep your cooperative strong.